U.S. truck tonnage surged in August

Here are five things worth knowing today:

read more

...Read the rest of this story

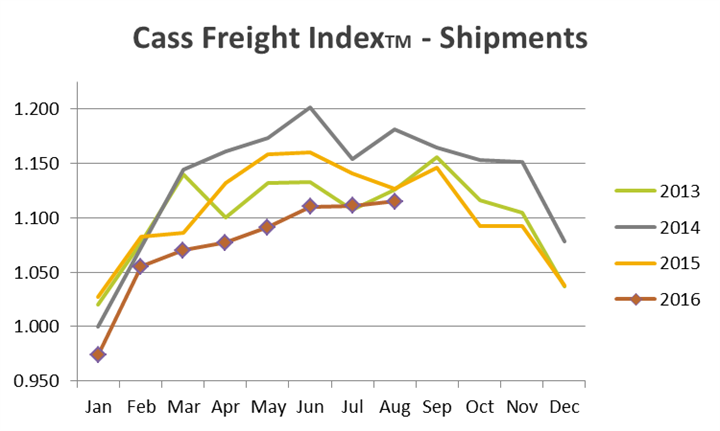

Freight shipments across all U.S. domestic modes continued improving in August but remain weak, according to the latest Cass Freight Index, while freight spending moved lower again with both resulting in mixed feelings when it comes to their economic impact.

Its measure of shipments increased 0.4% compared to July for a reading of 1.115, the highest level since last September, but is down 1.1% from August 2015, the 18th straight year-over-year decline.

According to the report, this most recent activity is mostly related to e-commerce, with lower levels of expansion being experienced in transit modes serving the auto and housing/construction industries. Also the increase in the month-over-month performance offers “a glimmer of hope that the contraction in volumes may be getting closer to an end.”

Figures also show freight spending declined during August, 3.3% from the month before and fell an even larger 6.3% from August 2015 for an index reading of 2.278, its lowest level since January.

“We continue to see this weakness as driven by the excess of capacity in most modes: trucking, rail, air freight, barge, ocean container and bulk,” said Donald Broughton managing director, chief market strategist and senior transportation analyst at the investment firm Avondale Partners, who provides analysis in the report. “The weakness is also driven in part by the ongoing decline in diesel and jet fuel and corresponding fuel surcharges that influence pricing realized by shippers.”

He says the August increase in freight volume certainly wasn't driven by railroads, as carloads and intermodal shipments both declined, while tonnage moved by trucking appears to be growing, though it's still down on a year-over-year basis.

Broughton says when it comes to freight rates in August, at first blush it appears that in most modes the gap between spot pricing and contract pricing appears to be closing slightly, but rather this is ...Read the rest of this story

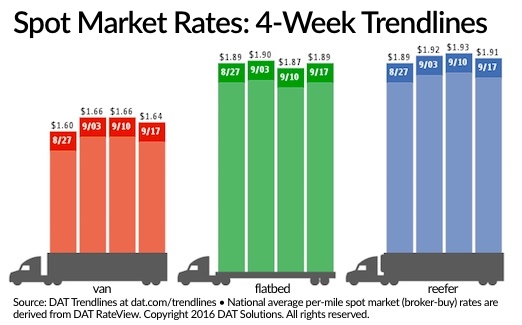

The number of loads on the DAT network of load boards gained 20% during the week ending Sept. 17 compared to the week before and the number of trucks added 19% as the spot market rebounded during the first full week after the Labor Day holiday but it barely translated into higher rates.

The national average van rate dropped 2 cents to $1.64 per mile and the reefer rate declined 2 cents to $1.91 per mile. The national average flatbed rate rose 2 cents last week to $1.89 per mile.

This happened as the national average cost of diesel registered $2.39 per gallon, down 1 cent from the week before. All reported rates include fuel surcharges.

The load-to-truck ratio for vans fell 4% to 3.1 loads per truck as van load posts increased 15% and truck posts jumped 21%. In contrast the flatbed load-to-truck ratio improved 8% to 13.2 loads per truck due to a 33% increase in load posts and a 22% gain in truck postings following an overall 21% hike in the ratio the week before at a time of year when it typically declines. Reefers moved up just 0.6% to 6.1 loads per truck as reefer load posts increased 14% and truck posts improved 13%.

Outbound van rates got a boost in several Western markets, including Los Angeles where the average rate added a penny to $2.02 per mile. As the bankruptcy of Hanjin Shipping Co. ripples its way through U.S. ports, DAT notes an 18% increase in loads week over week in the top seven van lanes out of the Los Angeles market, which includes the ports of L.A. and Long Beach.

According to DAT Analyst Mark Montague Hanjin's bankruptcy will no bout complicate efforts to get products from Asia to U.S. retailers' shelves before Black Friday, but that could benefit ...Read the rest of this story

The rollout of a new federal policy initiative by the Obama administration to further foster the deployment of autonomous vehicles (AVs) is getting mixed reaction to a degree from a variety of groups.

read more

...Read the rest of this story