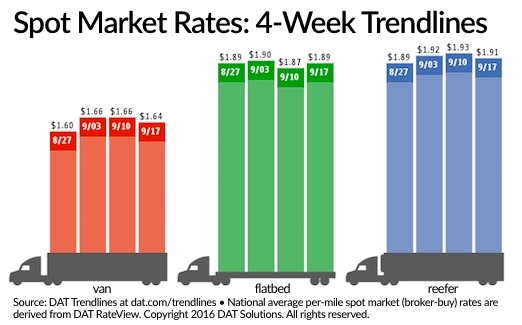

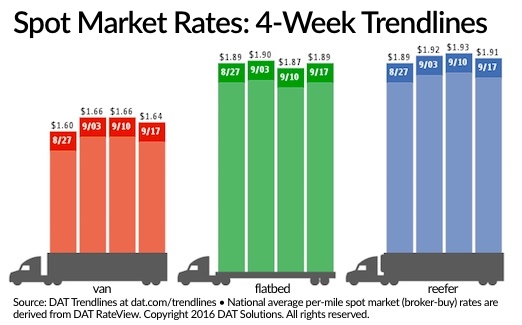

Spot Van, Reefer Rates Dip; Hanjin Bankruptcy Could Push Them Higher

The number of loads on the DAT network of load boards gained 20% during the week ending Sept. 17 compared to the week before and the number of trucks added 19% as the spot market rebounded during the first full week after the Labor Day holiday but it barely translated into higher rates.

The national average van rate dropped 2 cents to $1.64 per mile and the reefer rate declined 2 cents to $1.91 per mile. The national average flatbed rate rose 2 cents last week to $1.89 per mile.

This happened as the national average cost of diesel registered $2.39 per gallon, down 1 cent from the week before. All reported rates include fuel surcharges.

The load-to-truck ratio for vans fell 4% to 3.1 loads per truck as van load posts increased 15% and truck posts jumped 21%. In contrast the flatbed load-to-truck ratio improved 8% to 13.2 loads per truck due to a 33% increase in load posts and a 22% gain in truck postings following an overall 21% hike in the ratio the week before at a time of year when it typically declines. Reefers moved up just 0.6% to 6.1 loads per truck as reefer load posts increased 14% and truck posts improved 13%.

Outbound van rates got a boost in several Western markets, including Los Angeles where the average rate added a penny to $2.02 per mile. As the bankruptcy of Hanjin Shipping Co. ripples its way through U.S. ports, DAT notes an 18% increase in loads week over week in the top seven van lanes out of the Los Angeles market, which includes the ports of L.A. and Long Beach.

According to DAT Analyst Mark Montague Hanjin’s bankruptcy will no bout complicate efforts to get products from Asia to U.S. retailers’ shelves before Black Friday, but that could benefit …Read the rest of this story