<img width="150" src="http://www.automotive-fleet.com/fc_images/blogs/m-loadsmart-1.jpg" border="0" alt="

Photo: Loadsmart

">

Photo: Loadsmart

">Two contrasting bits of news about the so-called “Uber for trucking” marketplace hit my desk this week.

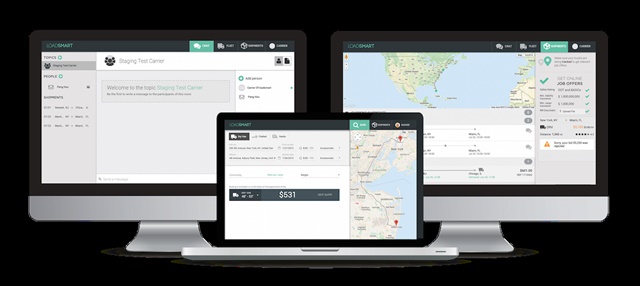

Loadsmart, which specializes in truckload shipping, announced that it has moved its first fully automated shipment from booking to delivery. No human contact occurred between Loadsmart, the shipper, the carrier or the driver.

The shipper requested a quote, and the system's algorithm generated a price instantly, which the customer booked in just a few seconds. The platform automatically identified the best carrier to move the load and sent an electronic request to the carrier's dispatcher.

With one click, the dispatcher accepted the job electronically and received an online rate confirmation instantly. The dispatcher then invited his driver to download the Loadsmart app. The app provided the driver with all the shipment details as well as GPS tracking for the dispatcher and customer. Upon delivery, the driver submitted the proof of delivery via the Loadsmart mobile app.

This “demonstrates that technology can and will have a big impact on the industry," said Felipe Capella, Co-Founder and Chief of Product at Loadsmart. "We are not your usual 'tech broker'. We are a technology firm: an engineering and design-driven team that is researching, prototyping and building transformative technology for logistics. We are not focused on incremental changes; we have created a tech lab to reimagine the whole truckload shipping flow – from booking to delivery.”

Meanwhile, DC Velocity reports that the segment may soon have its first casualty.

Citing confidential sources, the publication reports that Cargomatic Inc., a privately held company based in Venice Beach, Fla., has less than 60 days left of operating capital, and that its interim CFO, Seth Klein, resigned after less than a year at the job.

Cargomatic's core product is a digital platform connecting shippers directly with local truckers through a mobile app for drivers, targeted at local delivery markets.

However, DC Velocity notes that the company has resorted to traditional brokerage services to keep bringing in revenue while it waits for its app to catch on. But the brokerage segment is crowded and competitive, especially with recent sluggish freight demand.

“It has also alienated some brokers that had expected to be partners with Cargomatic rather than rivals, according to one of the sources. Cargomatic's model anticipated that brokers would account for about one-quarter of its business.”

Cargomatic was launched in June 2014 and currently serves Los Angeles, San Francisco, and New York.

It's not really "Uber for trucking"

Which brings us to the term "Uber for trucking." The phrase gets used a lot, referencing the pioneering ride-sharing app Uber. But is it really the same thing?

A few weeks ago, Armstrong & Associates, a research firm that tracks the third-party logistics market, published a report saying it's not.

A&A profiled 27 companies providing these type of services and concluded that “digital freight matching" is a much more apt description.

This companies, the report said, use digital platforms to match a shipper's freight with available carrier capacity. The goal is to better utilize motor carrier capacity by offering a convenient, digital app to connect shippers and carriers.

This sector has attracted more than $180 million in venture capital investment since 2011, including $67 million in 2016 alone.

The appeal is easy to see. Empty miles estimates range from 10-23% while e-commerce fulfillment costs are increasing. The natural response is to improve inefficiencies in the trucking industry with an Uber-like solution. After all, Uber addresses a similar problem (underutilized capacity in taxis) with a similar solution (a mobile app matching demand and supply).

But as A&A points out, freight transportation is not as simple as hailing a cab.

One of the key components of Uber's model is the commodity-like nature of the ride-hailing service, it points out. Domestic transportation is not a simple commodity. There are specialized equipment types, shipments transported via multiple modes, and handling service issues such as equipment breakdowns. Shipments are high-value and time sensitive. Placing an Uber-like app atop a complex industry doesn't truly address the problem.

In fact, A&A found most digital freight matching companies aren't simply mimicking the Uber model. Many even adamantly reject the term "Uber for Trucking." Instead, DFM apps include some of the functionality popularized by Uber – algorithmic pricing, API map integration, track-and-trace, and mobile transactions – along with features specific to trucking, such as trip planning, digital document storage, and TMS integration.

There's no doubt technology is changing how we connect shippers, carriers and drivers. But it's not as easy as catching a ride to the airport. Those companies that succeed in the digital freight matching space will most likely be the ones that truly understand the complexities of our industry.

Related: Uber, Amazon, and What the Sharing Economy Means for Freight Hauling

Follow @HDTrucking on Twitter