HDT Truck Fleet Innovators: It Pays to Focus on Data and People

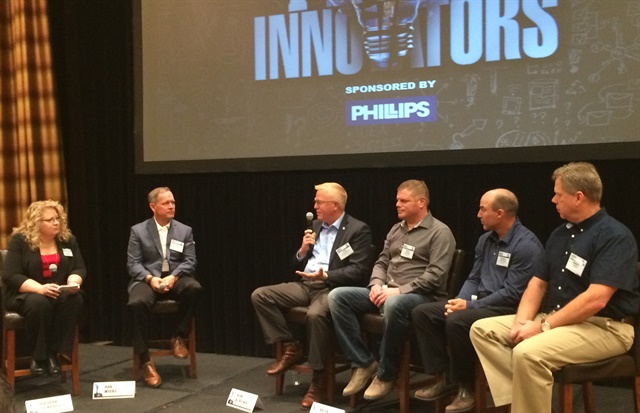

HDT's Deborah Lockridge and Phillips' Rob Myers discuss fleet management with Innovators honorees (l-r) Altrichter, Lo Priore, Obermeyer, and Swart. Photo: Jack Roberts

">HDT's Deborah Lockridge and Phillips' Rob Myers discuss fleet management with Innovators honorees (l-r) Altrichter, Lo Priore, Obermeyer, and Swart. Photo: Jack Roberts

">Using data effectively and getting the most from your employees were the dominant topics at a roundtable discussion featuring HDT's 2017 Truck Fleet Innovators honorees held May 9 at the Heavy Duty Trucking eXchange fleet networking conference in Phoenix.

The session, moderated by HDT Editor in Chief Deborah Lockridge and Rob Myers, vice president, sales for Phillips Industries, honored four fleet executives from around the country for their forward thinking and leadership in the trucking industry.

This year's HDT Truck Fleet Innovators and their citations are:

Kirk Altrichter, vice president of fleet services, The Kenan Advantage Group, North Canton, OH, for his work in helping the industry at large deal with the massive amounts of data flowing into fleet operations today as well as his passion for training and motivating employees.Ralph Lo Priore, director of fleet assets and processes, Stoneway Concrete and Gary Merlino Construction, Seattle, WA, for his new approach to spec'ing mixer trucks with an eye toward improving efficiency, productivity, maneuverability, and driver comfortRandy Obermeyer, terminal manager, Batesville, Logistics, Batesville, IN, for pioneering the use of lean management principles in a shop environment.Randy Swart, chief operating officer, A. Duie Pyle, West Chester, PA, for his work on the fleet's Leadership Development Program, which rotates recent college graduates in positions within the company to prepare them for careers in transportation operations.During the roundtable discussion, which followed the awards presentation, the four fleet executives remarked on a variety of subjects concerning trucking operations today.

When asked about leveraging data effectively, Altrichter said that not all data was "actionable," and stressed that a first step in using incoming information correctly is to concentrate on relevant data only, and ignore ...Read the rest of this story