Werner tops Street 2Q forecasts

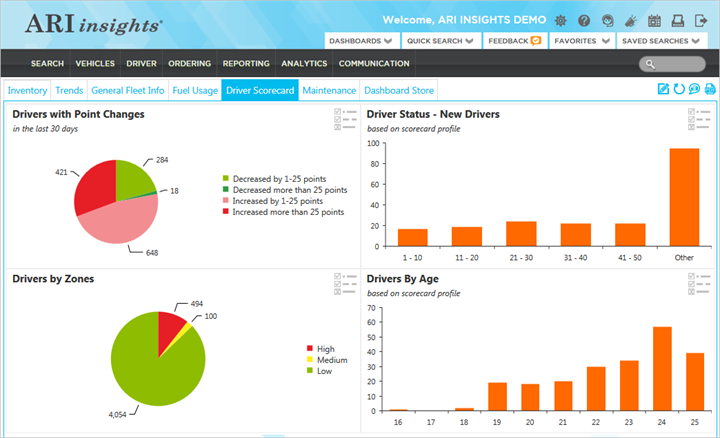

The ARI Driver Scorecard is a new tool from ARI designed to simplify how fleet managers can measure the performance of their drivers.

The Driver Scorecard allows fleet and safety managers to process driver data based on priorities within the organization by creating a singular score that is specific to each fleet. It pulls data from numerous sources including telematics providers, accident claims, fuel history, MVR reports, and violations to rank each driver with an overall score.

“With this tool, drivers can easily compare themselves to their peers,” said Rich Radi, director of the ARI Global Driver Excellence Program. “Everyone wants to excel at what they do, so we work with our clients to tap into this part of human nature and encourage better driving habits across the board.”

The tool is provided at no extra charge to ARI clients and is part of the overall ARI Global Driver Excellence program. The ARI Driver Scorecard monitors drivers for infractions, collisions, risk levels, fuel usage and other driving behavior data points.

“Our score is like a batting average, the fairest way to compare one baseball player's performance to another,” said Tony Candeloro, vice president, customer information systems and product development. “After looking at just one number, fleet or safety managers can take immediate action to improve high risk drivers in their fleet and recognize those showing consistently good, safe driving behavior. Once those on the low end of the scale have corrected their behaviors, they can raise the bar and work toward even better performance.”

Follow @HDTrucking on Twitter

Elisabeth Barna Photo: ATA

">Elisabeth Barna Photo: ATA

">The American Trucking Associations has named four executives to new senior leadership positions, according to the federation's new president and CEO, Chris Spears, as part of an "ongoing transition."

The new members of ATA's senior leadership team are:

“ATA is embarking on a transition and driving in a new direction, one I am proud to lead and prouder still to have these fine individuals and all the ATA staff play a part in,” said Spear. “We share the vision and goal of ensuring this essential industry continues to prosper and safely move our country forward.”

Barna, who has already begun working in her new role ,has been with ATA for 20 years, most recently serving as senior vice president of communications and public affairs. She also spent 8 years at the Motor Freight Carriers Association.

Hall will take up her new position on Sept. 3. She previously was general counsel and deputy staff director of the House Transportation and Infrastructure Committee. Hall also has experience in the executive branch of government, including at the Department of Homeland Security ,and in the private sector.

Hensley will start her new position on Aug. 15 and was most recently was senior vice president for public affairs and communications. She has also served as Deputy Assistant Secretary for Public Affairs at the Department of Labor; Associate Administrator of the Small Business Administration; and as House and Senate communications director for former Senator Tim Hutchinson (R-Ark).

Sullivan's first day at ATA will be on Aug. 15 as well. She joins ATA after serving as legislative director for Sen. Richard Shelby (R-Ala) and had previously held positions with the Department of Justice and on the staff of Sen. Lamar Alexander (R-Tenn.)

Spear, a former ATA senior vice president of legislative affairs, took over the top post at ATA on July 9. He succeeded Gov. Bill Graves, who is retiring after more than 13 years at the helm of trucking's biggest lobby.

Along with his prior tenure at ATA, Spear over the course of his career has served as a Capitol Hill staffer and in federal agencies as well as in the private sector. He most recently held the position of vice president of government affairs at Hyundai Motor Company.

“As ATA forges this new path forward, we are lucky to have quality leaders like Elisabeth, Jennifer, Sue and Bill join our already tremendous professional staff,” said Pat Thomas, ATA chairman and senior vice president for state government affairs at UPS. “On behalf of the members of ATA, I'd like to congratulate all of them and wish them nothing but success in their new roles.”

ATA stated that it will make additional leadership appointments in the coming weeks as the federation continues to transition under Spear's leadership.

Related: ATA Announces Chris Spear to Succeed Graves as President

Follow @HDTrucking on Twitter

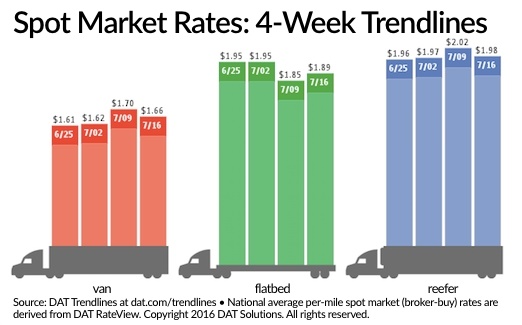

Spot truckload freight rates switched patterns over the past week, following seasonal highs hit by vans and reefers and a decline in flatbeds, as overall cargo volume was lower than anticipated, according to DAT Solutions and its network of load boards..

The number of available loads rose just 7% for the week ending July 16, well below the 20% expected rise following the holiday-shortened week before.

The average spot rate for reefer freight fell 4 cents to $1.98 per mile, still a penny higher than the national average in June. The van rate also declined 4 cents to $1.66 per mile, but that's 4 cents higher than the June average. In contrast, the national average flatbed rate gained 4 cents to $1.85 per mile, but far from erasing the 10 cents drop the week before.

This happened as truck posts on the DAT network increased 37% week-over-week causing load-to truck ratios to drop for all equipment types. Vans fell 26% to 2.6 available loads per truck while reefers dropped a little more, 27%, to 4.7 loads per truck. Flatbeds posted the smallest decline 14%, putting the load-to-truck radio at 13.4 to 1

The number of van-load posts gained 3% and truck posts rose 38% as outbound van rates declined in major markets. The highest outbound regional rates all posted declines over the past week, falling between 2 cents and 8 cents per mile.

The one bright spot was Memphis, where rates held steady at an average of $1.94 mile. Also the Memphis-Columbus lane jumped 15 cents to $2.03 per mile. That lane is associated with retail freight so this could be a sign of good things to come, according to DAT.

The number of reefer load posts dropped 4% while truck posts increased 32% for the week. Again, load activity was below expectations.

Rates fell in major regional markets in the Southeast and West. The average outbound rate from Los Angeles declined 9 cents to $2.58 per mile while Sacramento, Ontario, Fresno, and Twin Falls all had lower rates.

On the Mexican border, the average outbound rate from McAllen, Texas, gained 7 cents to $1.82 per mile and edged up on most high-volume lanes. Nogales, Ariz., fell 15 cents per mile with the Nogales-Los Angeles lane plunging 39 cents to $1.67 per mile.

Flatbed load availability added 18% and capacity increased 37%, leading to somewhat of a surprise that the average rate increased rather than fell in the sector over the past week.

Follow @HDTrucking on Twitter