Outlook for Freight Activity Seen as Improved

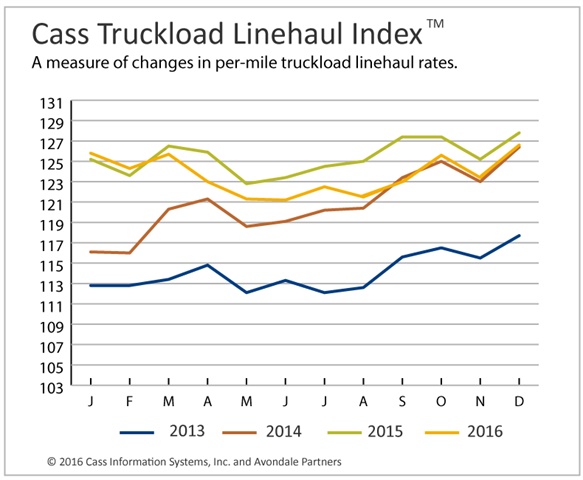

Graphic: Cass Information Systems

" >Three measures of freight activity and spending were mixed, according to new figures, but the outlook for their performances has improved, according to Cass Information Systems.

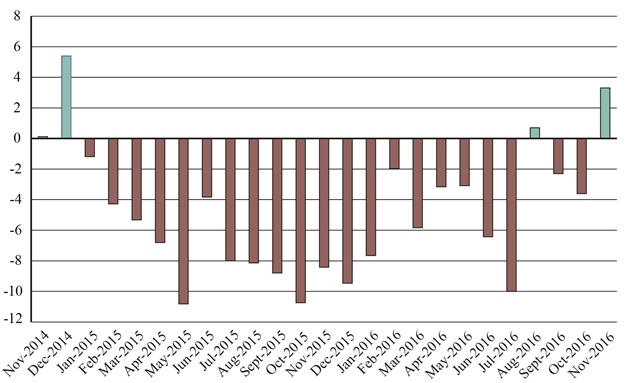

The Cass Truckload Linehaul Index, which tracks monthly changes in linehaul rates, fell 0.9% year-over-year in December to a reading of 126.6, marking ten consecutive monthly declines.

Graphic: Cass Information Systems

" width="350">Despite this negative trend, analysts at the investment firm Avondale Partners said, "the current strength being reported in spot rates is leading us to believe that our current -3% to 1% truckload pricing forecast may need to be improved or moved to a slightly more positive outlook if the strength in spot rates continues long enough to move contract rates back into positive territory."

One possible reason is that when the December reading is compared to the month before, it improved 2.6%. That marks its biggest month-over-month gain of 2016 and its highest reading since December 2015.

Meantime, the Cass Intermodal Price Index, which tracks changes in total intermodal per-mile costs including fuel, increased 1.5% year-over-year in December to a reading of 129.2. This follows year-over-year hikes of 0.3% and 0.4% in November and October, respectively, and is 2.8% higher in December than the level the month before.

Although diesel fuel prices have recovered from their early 2016 lows, "we do not expect a significant amount of sequential strength from intermodal," said Avondale Partners. “But, the current level of demand and pricing will produce a positive year-over-year comparison for the next nine to 10 months.”

The two indices are based on data from actual freight invoices paid on behalf of freight payment process Cass Information Systems clients.

Both reports came as the December results were released for the Cass Freight Index, which measures monthly levels of shipment activity, in terms of volume and expenditures.

Its measure of shipments showed an increase ...Read the rest of this story