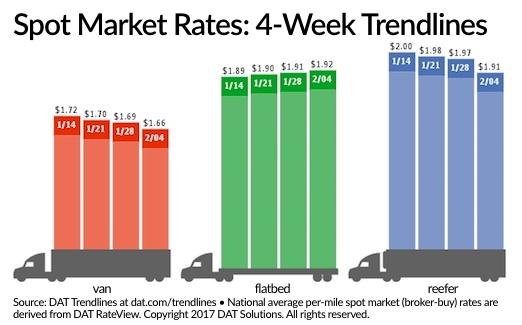

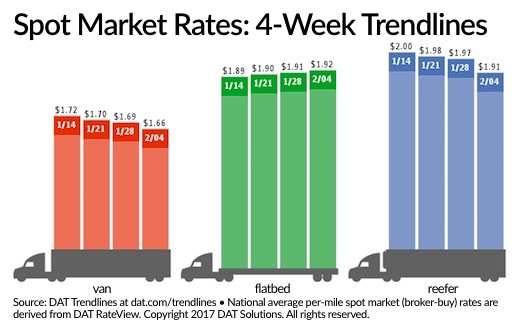

Spot Van, Reefer Rates Soften Over Past Week; Flatbeds Continue Inching Up

A 7.7% gain in spot truckload freight volume and a 2.1% dip in capacity were not enough to buoy spot truckload rates during the week ending Feb. 4, according to DAT Solutions and activity from its network of load boards.

While the national average flatbed rate showed a modest gain as van and refrigerated freight rates both fell last week. However, rates for each trailer types remain higher than they were in February 2016 while the average cost of diesel during the period was unchanged from the week before at $2.56 per gallon.

Flatbed load availability jumped 21% while the number of flatbed truck posts was virtually unchanged. That led to a 21% increase in the flatbed load-to-truck ratio to 21.9 loads per truck nationally.

The average flatbed rate edged up 1 cent to $1.92 per mile, the third straight week of penny-a-mile rate increases.

Regionally, spot flatbed rates were mixed as several top-paying lanes experienced a drop-off or modest gains:

Reno-Watsonville, California, $3.25 per mile, down 43 centsHouston-Fort Worth: $2.13 per mile, down 6 centsRoanoke, Virginia-Springfield, Illinois.: $2.83 per mile, unchangedBaltimore-Springfield: $2.85 per mile, down 38 centsThe spot market for vans was steady last week as the number of load posts increased less than 1% and truck posts fell 2%. The load-to-truck ratio gained 3% to 2.6 loads per truck and the national average rate slipped 3 cents lower to $1.66 per mile and is down from $1.72 three weeks earlier

Also, outbound rates declined in many major markets:

Dallas, $1.51 per mile, down 1 centAtlanta, $1.85 per mile, down 1 centPhiladelphia, $1.62 per mile, unchangedChicago, $1.96 per mile, down 5 centsLos Angeles, $1.90 per mile, down 5 centsIn the West, Stockton, Seattle, and Denver all slipped 5 cents lower compared to the previous week, and Denver-Chicago dropped below $1 a mile to 97 cents ...Read the rest of this story