<img width="150" src="http://www.automotive-fleet.com/fc_images/articles/m-hotline-graphs-1.jpg" border="0" alt="

The Cass Freight Index showed positive numbers in April for the fourth straight month, indicating a possible end to the “freight recession.” Source: Cass Information Systems

">

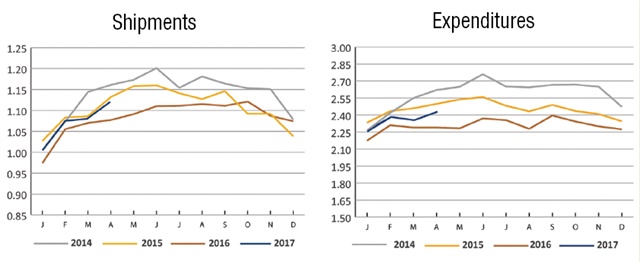

The Cass Freight Index showed positive numbers in April for the fourth straight month, indicating a possible end to the “freight recession.” Source: Cass Information Systems

">It seems just as soon as one report comes out saying there are indications the economy (and trucking) continues to get better, another follows that seems to point the other way.

The Cass Freight Index, which measures overall freight volumes and expenditures, showed both measures were positive in April for the fourth straight month. The writer of the report, Donald Broughton of the economic and equity research firm Broughton Capital, pointed out the “data is suggesting that the consumer is finally starting to spend a little.” The numbers, he said, indicated the “overall freight recession” that began in 2015 appears to be over, while freight seems to be gaining momentum in most segments and the overall economy “continues to get slightly better.”

But not everyone in trucking is feeling the positive effects equally.

For instance, consumers aren't spending at brick and mortar retailers. Just look at how many have closed this year or have reported lower sales. While parcel volumes associated with e-commerce continue to show outstanding rates of growth, according to Broughton, with both FedEx and UPS reporting strong U.S. domestic volumes, truckload volume isn't showing such growth.

Fewer truckload shipments are going to retailers and more is coming from distribution centers. Broughton noted figures from February, the most recent month available, show dry van loads fell on a year-over-year basis five out of the last eight months.

Then there's the American Trucking Associations For-Hire Truck Tonnage Index, which in April fell from the month before for the third straight month on a seasonally adjusted basis. The tonnage actually hauled by fleets before any seasonal adjustment fell 7.8% in April from March.

One likely reason, ATA Chief Economist Bob Costello