Bye, Big Banks. Hello, T-Mobile MONEY Introducing Your No-Fee, Interest-Earning, Mobile-First Checking Account

As more and more Americans manage their money on their smartphones, the Un-carrier steps up to make mobile banking better.

- What’s the news: The Un-carrier is launching T-Mobile MONEY nationwide: a no-fee, interest-earning, mobile-first checking account. Get as much as 4.00% APY!

- Why it matters: Americans paid $34 billion in overdraft fees in 2017. That’s not even counting all the other fees banks charge. And consumers earned next-to-zero interest on their account balances. T-Mobile MONEY changes the game.

- Who it’s for: Anyone who is tired of bank fees and wants to keep more of their money and grow it faster. So everyone.

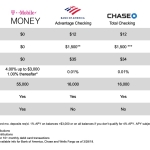

BELLEVUE, Wash.–(BUSINESS WIRE)–Another mobile pain point: tackled. Today, T-Mobile (NASDAQ: TMUS) launched T-Mobile MONEY nationwide. It’s a no-fee, interest-earning, mobile-first checking account that anyone can open and manage right from their smartphone. With T-Mobile MONEY, eligible Un-carrier customers can earn an industry-leading 4.00% Annual Percentage Yield (APY)* on balances up to $3,000 – 50 times higher than the average U.S. checking account1 – and 1.00 APY% on every dollar over that! Plus avoid all those big bank fees and overdrafts.

“Traditional banks aren’t mobile-first, and they’re definitely not customer-first. As more and more people use their smartphones to manage money, we saw an opportunity to address another customer pain point,” said John Legere, CEO of T-Mobile. “You work hard for your money … you should keep it … and with T-Mobile MONEY, you can!”

Keep More, Earn More

Big banks are built on fees. In 2017, Americans paid $34 billion … in overdraft fees alone!!2 And that’s just one kind of fee. Bank of America Advantage Checking has 19 different types of fees, and Wells Fargo Everyday Checking has 14!3 With T-Mobile MONEY, there are no fees — no monthly, overdraft or transfer fees, no fees at over 55,000 in-network Allpoint® ATMs worldwide** and no fees from T-Mobile for using out-of-network ATMs. Also, no minimum balance requirement!

And, you’ll earn more interest on your money, too. A lot more. T-Mobile postpaid customers can get 4.00% APY* on balances up to $3,000 and 1.00% APY on every dollar over $3,000 when they sign up with their T-Mobile ID and deposit at least $200 each month. Everyone else scores 1.00% APY on all balances.

Un-carrier postpaid customers can opt-in for Got Your Back overdraft protection when they sign up for T-Mobile MONEY, so when the unplanned happens, they can go in-the-red, up to $50, without penalty — just bring the account back to a positive balance within 30 days.

Banking Built for Mobile

Consumers are outgrowing traditional banks – 7 out of 10 consumers bank digitally4, and smartphones are the fastest growing digital platform.5 Yet less than half of traditional banks say they have a digital strategy6, and only 13% believe their core systems can keep up with digital innovation.7

T-Mobile MONEY is built to be mobile-first, and you can do all the things you need to do every day with your checking account right from the app – make mobile check deposits, set up direct deposit, pay bills, send a check, pay with a mobile wallet such as Apple Pay, Google Pay and Samsung Pay, transfer money, even make payments person to person. The app offers biometric security with fingerprint and Face ID login, account alerts and debit card disabling.

Plus, T-Mobile MONEY comes with a Mastercard® debit card you can use at more than 55,000 Allpoint ATMs worldwide – more ATMs than Bank of America, Chase or Wells Fargo.8 And you can use the T-Mobile MONEY app or web site to locate the ATM nearest you. Plus, your T-Mobile MONEY Mastercard offers Mastercard Zero Liability Protection.

T-Mobile MONEY is created in partnership with BankMobile, a division of Customers Bank (Member FDIC), and has been available in a limited pilot since November 2018. T-Mobile MONEY deposits are FDIC-insured up to $250,000. Customers can get 24/7 bi-lingual customer service and support with T-Mobile MONEY Specialists.

Get T-Mobile MONEY

To sign up, just download the T-Mobile MONEY app from the Google Play Store for Android 5.1 or later or Apple App Store for iOS 10.3 or later (or use T-Mobile MONEY online at www.t-mobilemoney.com). Sign up directly from your smartphone, and anyone – T-Mobile customer or not – can get an account. For personal support, you can sign up in any T-Mobile retail store or by calling 1-866-686-9358. T-Mobile customers can dial **MONEY. Residents of the 50 U.S. states 18 and older with a social security number can open an individual account. T-Mobile MONEY will come to Puerto Rico later this year.

For more information, visit: www.t-mobilemoney.com.

1 Bankrate, 2019

2 Moeb Services, Apr 2018

3 Wells Fargo, Bank of America

4 ABA/Morning Consult, Sept 2018

5 PwC’s Digital Banking Consumer Survey, 2018

6 Boston Consulting Group Global Corporate Banking, 2018

7 The Financial Brand, 2018

8 According to bank websites

* How APY works and what it means for you: As a T-Mobile MONEY customer you earn 4.00% annual percentage yield (APY) on balances up to and including $3,000 in your Checking account each calendar month when: 1) you are enrolled in a qualifying T-Mobile wireless plan; 2) you have registered for perks with your T-Mobile ID; and 3) you have deposited at least $200 in qualifying deposits to your Checking account within the current calendar month. Promotional deposits are not eligible toward the $200 in deposits. If you meet this deposit requirement in a given month we will pay you this benefit in the subsequent month as an added value provided all other requirements are met. This added value is subject to change. Balances above $3,000 in the Checking account earn 1.00% APY. The APY for this tier will range from 4.00% to 2.79% depending on the balance in the account (calculation based on a $5,000 average daily balance). Customers who do not qualify for the 4.00% APY will earn 1.00% APY on all Checking account balances for any month(s) in which they do not meet the requirements listed above. APYs are accurate as of 11/1/18, but may change at any time at our discretion. Fees may reduce earnings. For more information, see Account Disclosures / Terms and Conditions or go to our FAQs.

** May incur fees from ATM providers when using out-of-network ATMs or international ATMs and from Mastercard when making foreign transactions.

About T-Mobile US, Inc.

As America’s Un-carrier, T-Mobile US, Inc. (NASDAQ: TMUS) is redefining the way consumers and businesses buy wireless services through leading product and service innovation. Our advanced nationwide 4G LTE network delivers outstanding wireless experiences to 79.7 million customers who are unwilling to compromise on quality and value. Based in Bellevue, Washington, T-Mobile US provides services through its subsidiaries and operates its flagship brands, T-Mobile and Metro by T-Mobile. For more information, please visit http://www.t-mobile.com.

About BankMobile

Established in 2015, BankMobile is a division of Customers Bank and among the largest and fastest-growing mobile-first banking platforms in the U.S., offering checking and savings accounts, personal loans and credit cards. BankMobile, named the Most Innovative Bank by LendIt Fintech in 2019, provides an alternative banking experience to the traditional model. It is focused on technology, innovation, easy-to-use products and education with the mission of being “customer-obsessed” and creating “customers for life.” The disruptive, multi-partner distribution model, known as “Bank-as-a-Service” (BaaS), created by the executive team enables BankMobile to acquire customers at higher volumes and substantially lower expense than traditional banks. Its low-cost operating model enables it to provide low-cost banking services to low/middle-income Americans who have been left behind by the high-fee model of “traditional” banks. Today, BankMobile provides its BaaS platform to colleges and universities and currently serves over two million account-holders at nearly 800 campuses (covering one out of every three students in the U.S.). It is one of the Top 15 largest banks in the country, as measured by checking accounts. BankMobile is operating as the digital banking division of Customers Bank, which is a Federal Reserve regulated and FDIC-insured commercial bank. For more information, please visit: www.bankmobile.com.

About Customers Bank

Customers Bank (NYSE: CUBI) is a super-community bank with $9.8 billion in assets as of December 31, 2018, offering commercial and consumer banking services along the I-95 corridor from Washington, DC to Boston; and in Chicago. Commercial products include cash management; commercial and industrial loans; small business loans; SBA government-guaranteed loans; commercial and multi-family real estate loans; and financing for leasing businesses and residential developers.

Customers Bank provides consumer banking services including savings, checking, and money market accounts; certificates of deposit; residential mortgages; and consumer loans. Additional consumer products include “BankMobile Vibe online banking,” marketed by the BankMobile Division and “Ascent Money Market Savings,” marketed by the Customers Bank Digital Banking Division.

Customers Bank is a member of the Federal Reserve System with deposits insured by the Federal Deposit Insurance Corporation. Customers Bank is an equal opportunity lender. Customers Bank takes pride in delivering extremely high levels of customer service while charging comparatively very low fees; service that makes our clients say, “Wow.”

Commercial clients enjoy Single Point of Contact service with one team to handle all banking needs. Retail bank clients are afforded Concierge Banking® Services that brings banking to them, when and where they need it.

Customers Bank, with its headquarters located in Phoenixville, Pennsylvania, is a subsidiary of Customers Bancorp, Inc., a bank holding company. The voting common shares of Customers Bancorp, Inc. are listed on the New York Stock Exchange under the symbol CUBI. For more information, please visit: www.customersbank.com.

Contacts

Media Contacts

T-Mobile US, Inc. Media Relations

[email protected]

Investor Relations Contact

T-Mobile US, Inc.

[email protected]

http://investor.t-mobile.com

This article published with permission from Business Wire