Truckload Linehaul Rates Remain Soft, Intermodal Rates Continue Steep Drop

Truckload linehaul rates in June were nearly the same as the month before, but they are still below levels from a year ago, while there seems to be no end to the recent drop in rates for intermodal shipments.

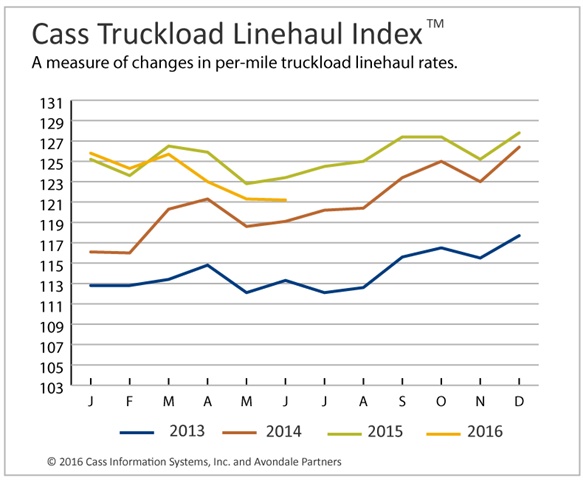

The Cass Truckload Linehaul Index fell another 1.8% year-over-year, after falling 2.3% and 1.2% in April and May, respectively, representing four consecutive months of year-over-year declines.

The index, which posted a reading of 121.2 in June, its lowest level since August 2014, fell 0.1% from May, the third straight monthly drop.

Analysts at the investment firm Avondale Partners, which provides analysis of the index, have further adjusted their pricing forecast range downward for the remainder of 2016 to a 1% to a 3% decline.

The report says several factors continue to contribute to the excess capacity that has caused rates to drop, including driver pay increases, overall fleet growth, reduction in carrier bankruptcies and an easing of the controversial 34-hour restart rule.

The index is an indicator of market fluctuations in per-mile truckload pricing, isolating the linehaul component of full truckload costs from other components, such as fuel and accessorials, providing a look at trends in baseline truckload prices.

Meantime, Cass Intermodal Index fell another 1.5% year over year in June, representing 18 consecutive months of year-over-year declines. Its reading of 121.1 also represents a 4.3% drop in June from May and is at its lowest level since January 2011.

Historically, there is a "high degree of correlation between truckload and intermodal pricing," said analysts with Avondale Partners. As contract rates for trucking continue to lose strength and move further into negative territory, “[this] would imply even more potential weakness for intermodal pricing."

The Cass Intermodal Price Index is a measure of market fluctuations in per-mile U.S. domestic intermodal costs that includes all costs associated with the move, such as linehaul, fuel and accessorials.

Data within both measures is derived from actual freight invoices paid on behalf of clients of payment processor Cass Information Systems, which totaled $25 billion in 2015.

Surprisingly, the figures follow a report from the day before showing freight shipments and expenditures edged up in June after three months of lackluster performance, hitting their highest levels of the year, according to the Cass Freight Index – but it remains unclear whether this is part of a larger trend.

Follow @HDTrucking on Twitter