<img width="150" src="http://www.automotive-fleet.com/fc_images/articles/m-vnomics-1.jpg" border="0" alt="

Our test truck was a rented 2013 Volvo VNL. Vnomic's development test truck is in the background. Photo: Jim Park

">

Our test truck was a rented 2013 Volvo VNL. Vnomic's development test truck is in the background. Photo: Jim Park

">Since you can't physically sit beside your drivers all day coaching their driving habits and performance, some sort of monitoring tool can be useful. However, if drivers see such devices as annoying or impeding their ability to drive, they won't happily accept the intrusion. A technology company in Pittsford, N.Y., has found a happy medium: a monitoring device that encourages drivers to do better without getting on their nerves or taking away drivability, while providing back-office data that helps fleets coach and instruct drivers on better driving habits to save fuel.

I recently paid a visit to Vnomics and saw how its engineers and developers had adopted the True Fuel technology from a military application. I also spent several hours in a test truck proving the system's ability to coax — rather than coerce — me into the green zone.

It's a simple system on the surface, with a huge amount of functionality built in.

The in-truck hardware consists of a reader that plugs into the truck's data port with a Y-cable (to keep the connection free for other applications such as electronic logs), and collects data on vehicle speed, power demand and engine operation. Each device is matched to the components on that particular truck. It reads sensor data from the ECU and sends it to the terminal in bursts via a cellular connection. There's no display to distract the driver; a tone is used to alert him or her to behavior that is problematic. The box is about the size of a paperback novel and it can be installed on or under the dash in less than 15 minutes.

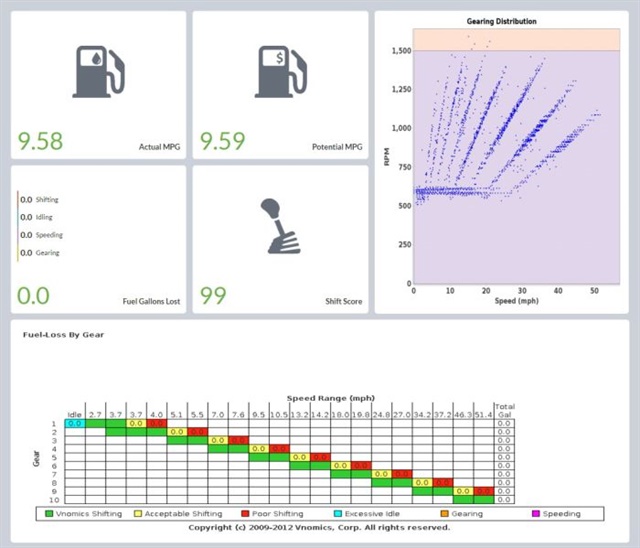

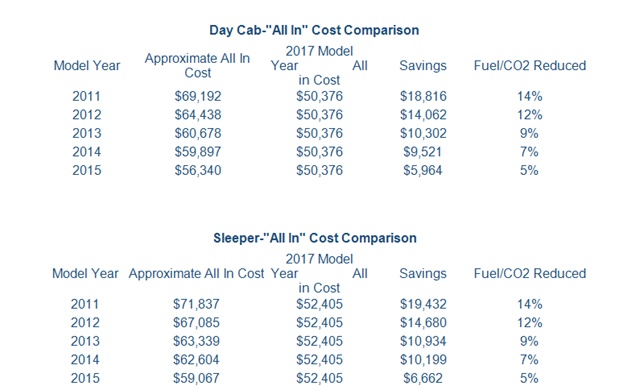

I'll skip over the intricacies of the back-office software. Managers see only a very straightforward interface that shows driver performance and historical trends as well as current and previous trip data. In addition to evaluating driver performance. True Fuel can compare truck performance and fuel consumption information and identify underperforming or improperly spec'd trucks.

Much of what makes this work so well is how Vnomics interprets and displays the data. Embedded in the system architecture are the engine's fuel maps as well as the specs and ratings to aid in interpreting the data. Layered over that are driver and environmental information that the system uses to determine if the engine is being operated as efficiently as possible. For example, the system knows if the truck is 400 or 450 hp, whether it's empty or loaded, on flat ground or on a hill. That's all significant, as the driving technique might be different in each case.

It doesn't use fuel consumed as a driver-rating parameter, but rather potential fuel economy: Given where you are operating on the fuel map, how close did you come to using the least amount of fuel needed to generate the required power for operation? This immediately deflates any arguments about driver fuel economy rankings being unfair because they are subject to external influences. It's really about whether or not the driver is operating the truck correctly.

Ben Stevens, Vnomics' sales engineer, explains it this way. If one driver is getting 7.2 mpg out of an algorithm-determined potential of 7.5, he's within 4% of the target, which isn't bad. However, another driver might be getting 6.1 mpg out of a potential 6.2.

In testing Vnomics True Fuel, I made two runs over the same course, mostly stop-and-go driving with a little freeway time. We were bobtailing in a leased tractor with a manual transmission (the system works equally well on automated and automatic transmissions, too). I don't think the fact that we were bobtail matters, because again, the system was watching performance, not fuel consumed.

For the first run I put my bad driver hat on and deliberately drove as poorly as I could — hard braking, idling too much, taking gear changes to wildly high rpm, running in the wrong gear, etc. It was so against my nature to drive like this that I really had to work at it.

My score was a 46 out of a possible 100. I thought it would be much worse given how badly I was behaving. Stevens told me he has seen drivers with scores in the low 20s. I can't even imagine how badly you have to screw up to earn a score like that.

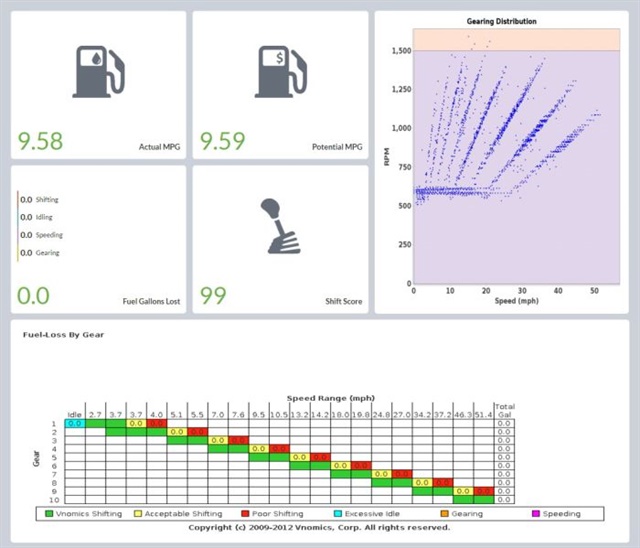

Run 2 was the Good Jim run. I diligently tried to keep the revs down, accelerate gently, minimize idling, skip gears, etc. I did pretty well, causing the alert to sound only three times for a score of 99.

Incidentally, each of the three times I messed up and over-revved a gear, I was talking to Ben. This was a real an eye-opener for me. The conversation distracted me from concentrating on my shifting. I can certainly drive properly when I'm thinking about it, but I could never maintain that level of concentration all day long.

And that may be the real benefit to True Fuel. A good, diligent driver gets a gentle alert from a not-unpleasant-sounding beep to remind him or her that they are slipping. That's a lot easier to take than finding out at the end of the month that you blew your fuel bonus.

VIDEO: Vnomics Test Drive Pt. 1- Bad Driver, Vnomics Test Drive Pt. 2 - Good Driver

Follow @HDTrucking on Twitter