Orange EV Launches Class 8 Electric Truck

Orange EV's all-new Class 8 pure-electric terminal truck. (Photo courtesy of Orange EV.)

">Orange EV's all-new Class 8 pure-electric terminal truck. (Photo courtesy of Orange EV.)

">Orange EV, a manufacturer of electrification solutions for industrial fleets, is now accepting orders for its all-new T-Series pure-electric terminal truck.

The new T-Series pure-electric truck has 24-plus hours of use per charge, and can be fully charged in as few as two hours.

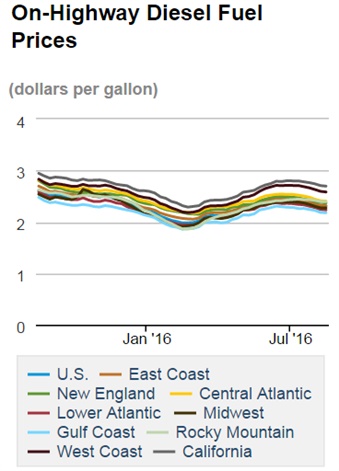

In addition, fuel savings depending on moderate or heavy use can be from $10,000 per year, per vehicle up to $60,000 per year, per vehicle (using 2015 average diesel prices). A fleet of 20 vehicles, with moderate use, can save from $200,000 to $400,000 per year overall, according to Orange EV.

Orange EV's initial T-Series, a complete remanufacture of existing trucks, has been operating up to 24-plus hours per charge at sites from single-shift to 24x7 in railroad intermodal, LTL freight, manufacturing, retail distribution, waste management, and warehouse container handling fleets.

By placing a $10,000 refundable deposit by Dec. 31, 2016, fleets lock in the price, receive production priority, and Orange EV's telematics service free of charge on trucks (the telematics service will be provided free of charge on all trucks ordered by March 31, 2017.)

“With the addition of the new truck and rise in overall order volume, production capacity is at a premium,” said Wayne Mathisen, CEO at Orange EV. “Fleets have been telling us for two years that they want a new truck option. Now they can get it in the same industry-leading chassis they already know and rely on. Orange EV's Priority Program will help us gauge the demand and allocate resources while rewarding fleets that help us plan ahead.”

Fleets in the Priority Program place $10,000 refundable deposits and enjoy:

- Price stability through year-end budgeting.

- Installation and remote access for Orange EV's FIMS service, free of charge for five years.

- Live user training and initial Fleet Information Management System (FIMS) user reports. The FIMS telematics service provides real-time information on truck performance.

Orange EV will continue taking orders as fleets are ready. Each month, the company will query program participants in sequence for their orders to help new fleets begin the process while ensuring ready units begin their deployments as soon as possible.

Financing, incentives, carbon credits, and other programs provide fleets additional assistance and incentives to accelerate deployment of Orange EV's pure electric terminal trucks. Traditional equipment financing helps reduce initial cash outlay and fund the balance of purchase from cost savings. Federal and regional programs exist to further reduce purchase price and spur adoption.

According to the company, Orange EV has consistently been the first OEM approved for and delivering commercially available terminal trucks under incentive programs that can pay more than half of vehicle purchase price. Carbon credits on the emissions eliminated by Orange EV electric vehicles can generate even more savings.

“Even without incentive programs, the total cost of ownership for Orange EV's electric vehicles is often less than what many fleets spend to purchase and operate their diesel trucks,” according to Mike Saxton chief commercial officer at Orange EV. “The incentives help fleets invest in their initial vehicles, but it's the per truck savings of up to $60,000 annually that will drive fleet-wide adoption."

Follow @HDTrucking on Twitter