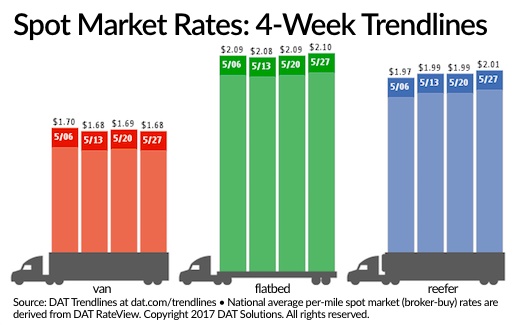

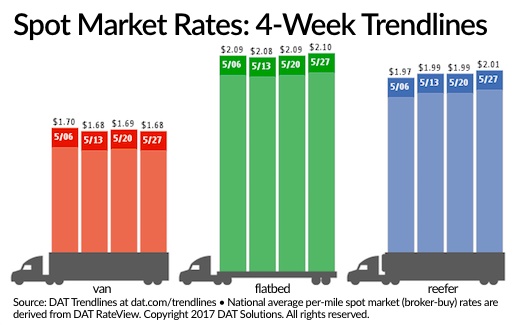

National average spot truckload rates for refrigerated and flatbed freight increased during the week ending May 27 while the rate for van freight slipped due to a lower fuel surcharge, despite strong freight volumes.

DAT Solutions reported the number of available loads on its load boards increased 2.3% compared to the previous week and posted truck capacity fell 0.7% as truckers parked equipment to avoid pre-holiday traffic.

Load-to-truck ratios for vans and reefers ended the week higher, up 13% and 8%, respectively. The van ratio came in a 4.2 loads per truck, it highest level since January, while reefers registered 7.8 loads per truck. In contrast, the flatbed ratio declined 11% to 34.2 loads per trucks.

A 1-cent drop in the national average fuel surcharge caused the van rate to dip a penny to $1.68 per mile. All rates include fuel surcharges.

Nationally, the number of posted van loads increased 12% while truck posts declined 2%, likely signaling the start of summer retail shipments, according to DAT.

Rates on the top 100 van lanes surged with the strongest showing of the year and outbound rates were up in almost every major van freight market:

Los Angeles: $2.09 per mile, up 7 centsChicago: $1.93 per mile, up 7 centsHouston: $1.82 per mile, up 5 centsCharlotte: $2.06 per mile, up 10 centsPhiladelphia: $1.67 per mile, up 2 centsThe national average rate for reefers was $2.01 per mile, up 2 cents compared to the previous week and its highest level out of the past four weeks. Reefer load posts gained 9% while truck posts fell 4%.

Central California produce volumes returned in a big way. Outbound reefer rates soared 13% to $2.41 per mile in Fresno, led by several key lanes including Fresno-Denver surging 52 cents to $2.70 per mile while Fresno-Chicago was up 35 cents to $2.16 per mile

The